Story behind

The forex market is wild country. There are no rules, no laws and no governing body. You and you alone are responsible for your money, and everyone else out there is trying to get it from you. Foreign exchange currency trading is a risky business, and the stakes are high – there’s as much to lose as there is to win. Without proper risk management, traders get eaten alive.

smartFX Platform is my tool for dealing with the inherent risk of the forex market, to help turn what was little more than amateur gambling into a serious investment portfolio with a solid strategy. It’s built of my years working in the risk field, fine-tuning the risk applications the big banks use for their own forex dealers, as well as my own experiences investing my own money, and getting my fingers burnt, on the currency market.

I trade my own money, and most of the time I am able to trade smart and earn well. However every now and then I have a bad week that could wipe out all the gains of the last six months. We’ve all been there, and we know the frustration. We want to blame the market, or our bad luck, but the harsh reality is that it was our fault – trading like a gambler.

What kind of mistakes do I make in a bad week? Simple – the same things other forex traders do: trading without stop loss, widening or removing stop loss, adding new trades to a losing position instead of closing them, trading much bigger position than was planned, and being on the market all the time and overtrading. All those lead to a bad night’s sleep, which in turn leads to a lack of concentration. This creates a downward spiral of even worse trading and much heavier losses.

Dealers in banks make exactly the same mistakes. However, they have one very important advantage over retail forex traders – corporate hierarchy and risk management systems. Risk management systems limit a trader in fields like overall position, position per currency pair or limit per counterparty. If, despite the defined limits, a dealer loses money for a couple of days in a row, he has a serious talk with a supervisor and is moved away from trading for some time. The dealer has time to think through his trading mistakes, to recover and to gain the ability to trade well again.

Using smartFX Platform you now have those same possibilities. The two-level user hierarchy allows you to separate the administrator, who sets the limits, from the trader who is only allowed to trade within those specified limits. There are number of limits that can be defined. If a trade or action exceeds a limit then the trade will not be sent to the broker. The trader and administrator are in complete control of risk; the application constantly calculates the limits and risk in real-time. Every single second, you know exactly how much you could lose in a worst case scenario or how much you could earn when things go just right.

Limits

smartFX Platform allows to configure number of limits. The limits can be turned on or off, set or not set. However there is one limit which cannot be turned off - every order has to have a stop loss defined, otherwise a trade is not send to Dukascopy™. The following is a list of currently available limits:

- Trading only at better price If activated, the trader will be able to trade at better price only. For example, a trader has an open long EUR/USD position at 1.3000. He will be able to open a new long trade on EUR/USD only if the current price is above 1.3000. If the price is lower, the order will not be accepted. Thanks to this the trader never increases a losing position, only the winning ones.

- Cannot widen Stop Loss If activated, the trader will not be able to widen the stop loss of currently opened trades.

- Maximum VAR Value at Risk is the amount which you lose in the worst case scenario when all your stop losses get hit. If the current VAR and risk amount of a trade is higher than the defined limit, the trader will not be able to place any new trades until some of the opened or pending trades are closed, or the stop loss size of already opened trades is decreased.

- Maximum risk per trade Risk amount of a trade must be smaller than the limit otherwise the trade will not be accepted.

- Maximum loss per day If the trader reaches maximum loss per day, trading will not be possible for the rest of the day. It is good to use that time to analyze today’s trades for improvement.

- Maximum loss for 7 days If the trader reaches maximum loss for 7 days, trading will not be possible at least until the end of the day. To check if the limit has been exceeded, the application takes into account profits and losses of trades closed within the last 7 days alongside the risk of open and pending trades.

- Maximum loss for 30 days. If the trader reaches maximum loss for 30 days, trading will not be possible at least until the end of the day. To check if the limit is exceeded, the application takes into account profits and losses of trades closed within the last 7 days alongside the risk of open and pending trades.

Risk values can be expressed as percent of equity or as absolute amount in account currency.

Screenshots

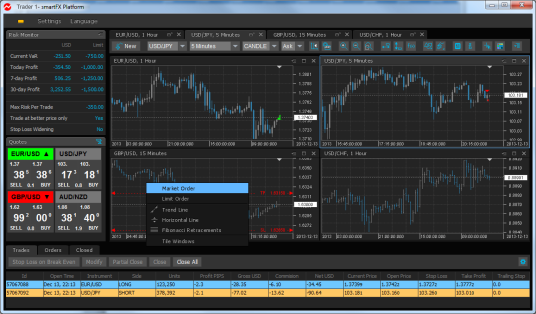

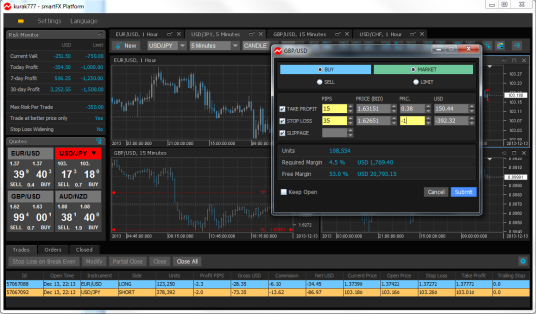

The Platform - Main window

Click on image to enlarge

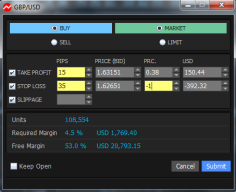

Main window with Market Order window

Click on image to enlarge

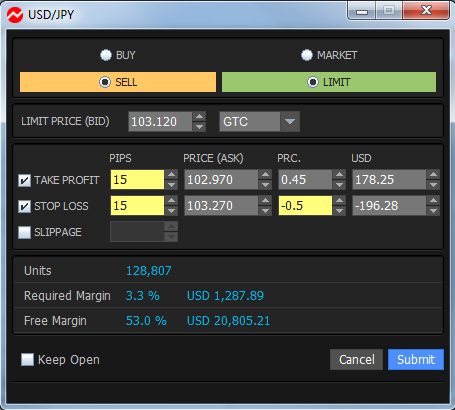

Limit / Stop Limit Order window

Click on image to enlarge

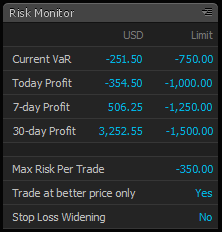

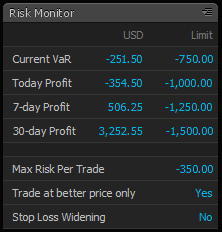

Risk Monitor

Click on image to enlarge

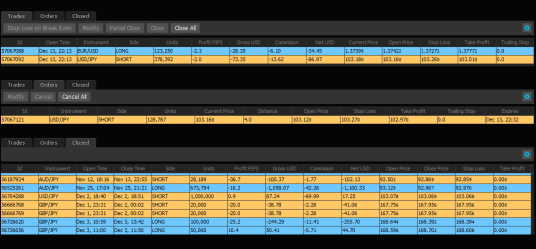

Available data tables

Click on image to enlarge

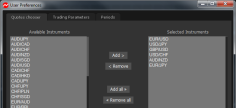

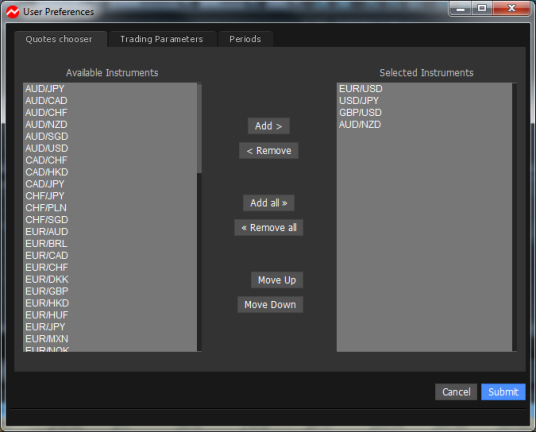

Settings - Quotes chooser

Click on image to enlarge

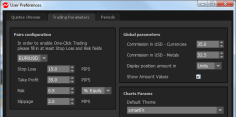

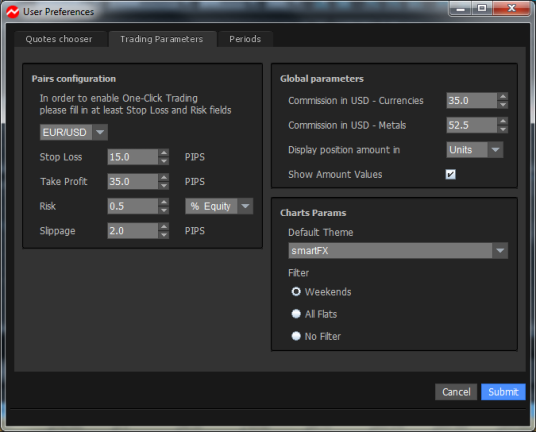

Settings - Trading Parameters

Click on image to enlarge

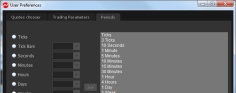

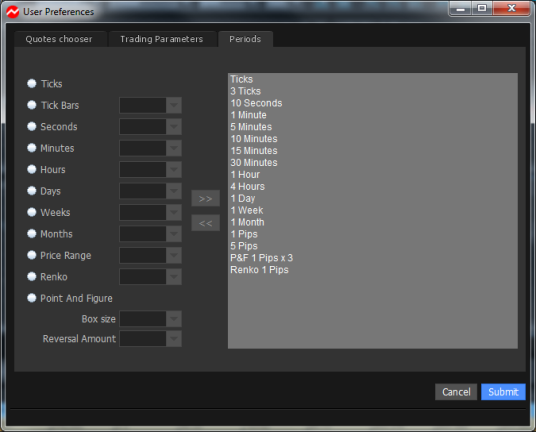

Settings - Periods definition

Click on image to enlarge

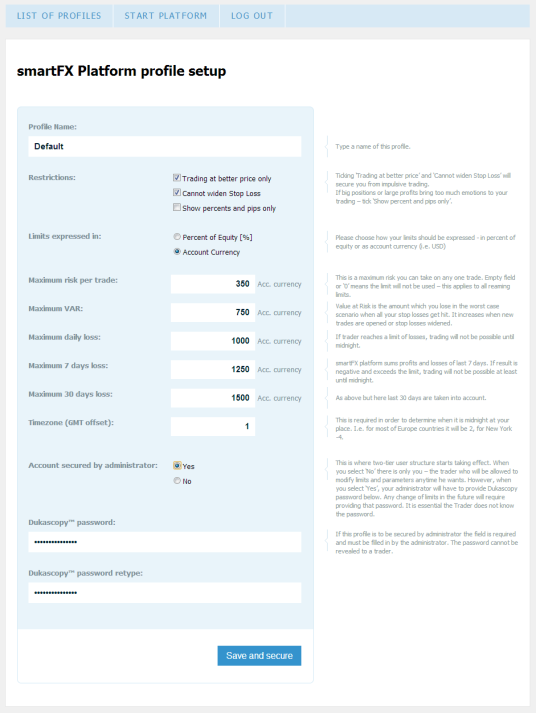

Risk profile definition and securing

Click on image to enlarge

How it works

Getting Started with smartFX

Registration

In order to use the smartFX Platform, a smartFX Platform account is needed. Accounts can be created by pointing your browser at following address: https://smartfx.eu/platform/register.php.

The trader provides only his e-mail address which is used as username, password and reCaptcha. After successful account creation, a mail is sent to the provided e-mail address with a confirmation link. Please check the relevant email account to continue the confirmation procedure, which is required to activate the account.

Once the email account has been confirmed, it will be possible to log in to the smartFX Platform via the web interface.

Logging in to web interface

The web interface allows traders to create and configure risk profiles. Traders can log in to the web interface using their smartFX Platform credentials at following link: https://smartfx.eu/platform/login.php.

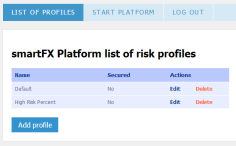

Risk Profiles

Risk profiles allow a trader to automatically set their restrictions and limits for daily trading.

After successfully logging in, the trader is taken to the List of Profiles page. From this page the trader can start the platform, and create, edit and delete user profiles. If this is the first time the trader has logged in, he should see a default profile that is ready to use.

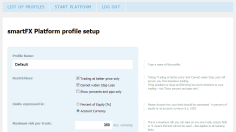

Configuring a risk profile

Let’s focus on configuring the limits. For this, we will use the Default profile as a base.

In order to modify the profile, click Edit. You will be taken to a page where you can change the name of the profile, and define its restrictions, limits, GMT offset and, if necessary, secure the profile with a password.

The trader can define any name he likes to identify the profile.

Restriction’s options and limit’s parameters are explained on right side of the page. Limits can be expressed as a percent of current equity [%] or in the currency of the account.

The trader should also define the GMT offset for the application, to know when it should recalculate daily profits, risks and limits. If no offset is provided, the daily limits will be recalculated at midnight (00:00) GMT.

If you do not secure the profile, you can still provide a password. With this feature, you will not have to provide your Dukascopy password each time you log in to the smartFX Platform. The password will be stored securely in encrypted form on smartFX servers.

Two-tier architecture

smartFX Platform is not just another trading platform. What differs it from other platforms are the implemented risk management solutions. To take full advantage of the risk management solutions, it is crucial to understand the two-tier structure of the Administrator and the Trader.

This first release of the Platform is intended for personal usage. We can distinguish between two scenarios. First: you are a Dukascopy account owner but wish to give access to your trading account to other trader, but only within defined risk limits. Second: you are a trader and want to put limits on yourself with the help of an administrator. These two scenarios are described and explained below.

Why would anyone want to limit himself? Everyone who has been on the Forex market for a while knows perfectly well that Forex trading is not only about struggling with the market but also with his own impulsive trading, lack of discipline, overtrading and not following a money management plan. A properly configured smartFX Platform protects the trader from all the above issues.

It is very important to choose an Administrator wisely. It should be a person who you trust and who understands that Forex is a risky business. It may be your spouse, parent, brother, sister or a friend. The Administrator is a person who will make sure you don’t have access to the regular JForex platform to trade without limits by keeping Dukascopy password secret.

PLEASE NOTE: The two-tier feature is available to clients using Legal Entities type account and Joint type accounts, where one of the account holder is The Administrator and the other account holder is the Trader.

Securing the profile

This feature allows perfect security of your trading account. Most steps of this operation should be performed by the Administrator and the Trader together. However the first step should be should be performed by the Administrator who logs in to the Dukascopy Entry for traders page. After logging in to the trader’s section, the Administrator changes the password to the Dukascopy account. The password cannot be revealed to the trader.

The next step is to open the risk profile on smartFX.eu website, tick Yes next to the Secured by administrator parameter.

The last step is for the Administrator to enter new Dukascopy password in both password fields and click Secure and Save. The password is stored securely in encrypted form on smartFX servers.

To Unlock the profile, a matching password should be provided.

Starting the platform

You can start the smartFX Platform by clicking following the link, by clicking Start smartFX Platform at the login screen, or by clicking Start the platform when you are logged in to the Platform section

smartFX is a standard Java Web Start Application. When you click one of the above links, a JNLP file will be downloaded. The application will start loading when you run the file. If there is a newer version of the platform, you will be notified at the start of the application.

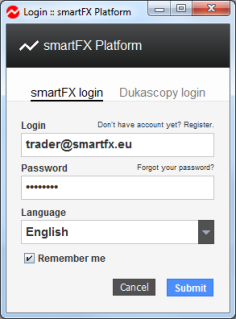

Logging in to the platform

The first screen you will see after starting the application is the smartFX login screen. You should provide your smartFX Platform credentials. You are able to select the language that will be used by the application. The language can be changed later from within the application.

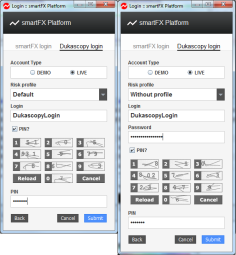

After successfully logging in to smartFX, you will be taken to the Dukascopy login screen. You can choose whether to use a Live or Demo account, and select a risk profile or decide to use the platform without any profile. If the profile is secured, or you provided a password for the profile, then you are only required to provide a Dukascopy login and PIN if required for your account.

After clicking the Submit button, the login process will begin. The application should load within a few seconds. If the main window does not start within two minutes, please restart the application.

Trading and risk monitoring

Logged in users are taken to the main screen. This is a place where you can monitor your risk and profit, analyze charts, place trades, adjust settings, and monitor your open, pending and historical trades.

The main screen is divided into individual charts representing your currency pairs. The right hand side of the screen displays these same pairs, and are conveniently placed for one-click trading.

Placing trades

Trades can be placed in two ways.

From the chart. Right-click on any chart. A context menu will show up. You will be given options to open a market or limit order window.

From the quote panel. Clicking on any of your current quotes will open the order window. If the one-click toggle button is selected then clicking on buy or sell side of any quote will trigger instant order execution on given instrument. One-click trading is only available for pairs which trading parameters were defined for. Trading parameters can be defined in the Settings window of the Trading Parameters tab. The window can opened from the upper menu.

Order Window

The Order window allows the trader to place Market, Limit and Stop Limit orders. The Trader does not set position size; this is calculated automatically. The size is calculated based on Stop Loss size and risk amount, or Take Profit size and profit amount. Limit and Stop Limit orders are supported. If a trader is taking a long position, and we place a limit order with an entry price below the current price then this order will become a regular Limit order. If the entry price is higher than the current market price, then this order will become a Stop Limit order.

Risk monitoring

The Risk monitoring panel allows the Trader not only to monitor his risks but also to observe the defined risk parameters and monitor the current and historical profits. The values can be expressed in account currency values or as a percent of current equity.

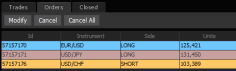

Trades modification and monitoring

The bottom panel allows the trader to monitor live, pending and historical trades (up to 30 days). On the Trades tab the trader can monitor currently live trades. There are 5 buttons available for the tab. The Trader can:

- set stop loss to be moved on Break Even Point for currently selected line(s);

- modify one or more orders at the same time;

- partially close one or more orders the same time;

- close selected orders;

- close all currently live trades.

The Orders tab consists of pending orders (Limit and Stop Limit). Using the tab, the Trader can modify the selected order or cancel it if needed.

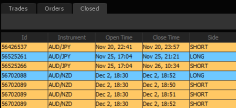

The Closed tab consists of historical trades closed within the last 30 calendar days.

Each tab allows the trader to choose which columns he wants to be visible.

Configuring platform and trading parameters

From the top menu you can open the Settings windows. From here, you can choose which quotes are visible on the Quote Panel. On the second tab, Trading Parameters, you can configure default trading parameters for every pair. You can also set your commission which is used to accurately calculate your position size. On this tab you can also define a default theme for newly opened charts and files. The last tab, Periods, allows you to create your own set of periods.

Technical analysis

The Platform allows you to use the same technical analysis tools as the regular JForex platform. You can add all the usual indicators, including custom indicators. You can draw the same lines, shapes and symbols. Additionally you can draw basic lines directly from the context menu by clicking the right mouse button.